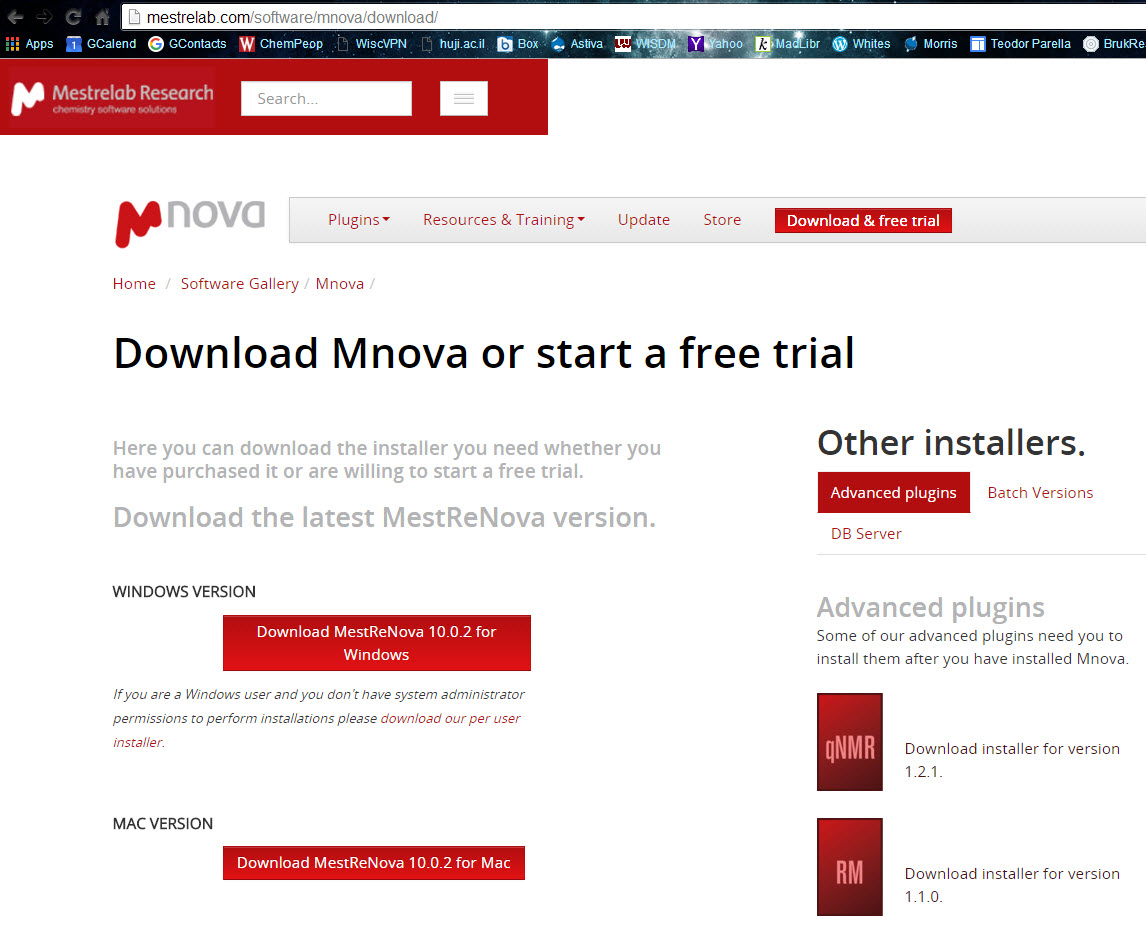

From the Desktop with Finder Menu, Select Go.You will see the three license files, now download MNova.For log name enter “austin\ your EID” and then your password.Select Reconnect at login and Connect using different credentials.At the top of the window click on Map network drive.

MestReNova requires additional license files.

The structure and support that Ginnie Mae has brought to this market has increased its liquidity, which translates into better execution on the securities and, ultimately, lower costs for the growing population of senior citizens. The unpaid principal balance of HMBS climbed to $48.9 billion in FY 2014, and the number of participations (the funded portions of HECM loans that have been securitized) increased to 6,585,856.ĭemand in the structured market for HMBS remains strong 22 H-REMIC transactions were issued in FY 2014, up from 32 in FY 2013. With continued investor interest in HECM-backed securities, significant efforts have been made to support market demand for reverse mortgages. They also can serve as collateral for Real Estate Mortgage Investment Conduits (REMIC) backed by HMBS (H-REMICs). HECM loans can be pooled into HECM mortgage-backed securities (HMBS) within the Ginnie Mae II MBS program. In addition to traditional mortgages, Ginnie Mae’s expanding Home Equity Conversion Mortgage (HECM) securities program provides capital and liquidity for Federal Housing Administration (FHA)-insured reverse mortgages, an essential financial solution for a growing number of senior citizens. Home Equity Conversion Mortgage-Backed Security (HMBS) Program Approved Digital Collateral Program Participants.Supplemental Loan Level Forbearance File.

0 kommentar(er)

0 kommentar(er)